Some of Africa’s Almost 700 Tech Hubs Playing “Pivotal” Business Roles

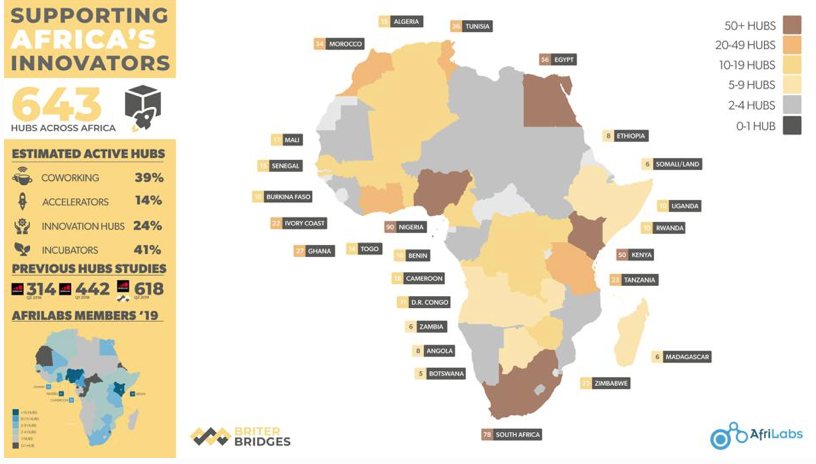

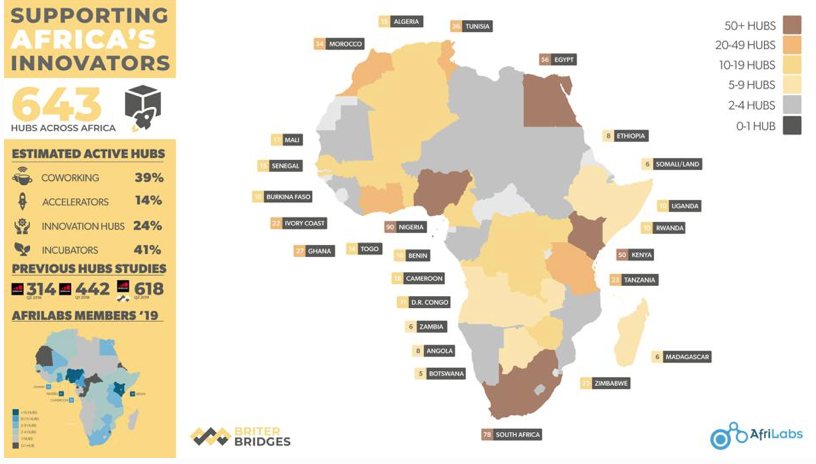

Even though Africa’s tech hubs have grown to a new record of 643 across the continent, some 25% of them only provide coworking spaces, presenting an opportunity for greater growth, according to a new survey.

The research by Briter Bridges and AfriLabs is some of the most detailed about the tech hub ecosystem, and explores how the hubs finance themselves, offer startups.

It found that 41% of these facilities are incubators,24% are nnovation hubs, 14% are accelerators and 39% offer coworking space.

Nigeria has the most hubs per country, with 90, followed by South Africa’s 78, Egypt’s 56 and Kenya’s 50 in the 34 countries it covered. The report – called “Building a conducive setting for innovators to thrive” – found the majority of the surveyed hubs received less than $100,000in funding from various sources, while 62.2% of hubs have less than 10 paid employees.

Almost half of the existing hubs consist of non-profit organisations or donor-funded organisations, with 60%of all respondents receiving funding. Donors, corporate sponsors, philanthropic organisations, and NGOsare the most active funders.

Excluding donor funding, the report found 53,3% of hubs charge a membership fee and 62,2% receive funding for programmes.

Earlier this year a GSMA report, using Briter Bridges research, found 618 active tech hubs, a 40% leap of “incredible growth” over the 442 hubs counted last year. These hubs have provided “the backbone of Africa’s tech ecosystem,” the GSMA said. The number of its identified hubs has grown from 314 in 2016 to 442 in 2018 and 618 as of Q2 2019.

In September the two most well-known tech hubs in Africa combined, with Lagos’s CcHub buying iHUB in Nairobi. Bosun Tijani, CcHUB’s chief executive officer, said this was to “create a robust platform that’s capable of attracting the best resources and partnerships to accelerate the application of technology and innovation for economic prosperity across Africa”.

Read also: Blusimba Launches Platform To Aid Digitization Of Businesses Operations

“Hubs represent a lot of potential in terms of facilitating growth and creating synergies across the entrepreneurial ecosystem, but just like the startups they support, they need a conducive environment to thrive,” Lisa With, co-head of research at Briter Bridges, told me.

Two of the key constraints are the lack of adequate funding and stringent regulations, which he says could be addressed by “more visible and tangible support” from governments.

Temitope Isedowo, AfriLabs’ director of programmes, agrees. “I think governments mostly need to regulate less and make any regulation or policy intervention youth and stakeholders-led,” he told me.

With also emphasised the need for support. “Hubs represent a lot of potential in terms of facilitating growth and creating synergies across the entrepreneurial ecosystem, but just like the startups they support – they need a conducive environment to thrive.”

Briter Bridges founder Dario Giuliani adds: “African economies are witnessing a fast rise in the degree of business activity, “with a special concentration in major cities such as Cairo, Nairobi, Lagos, Abidjan, and Dar es Salaam. Several “secondary’” cities such as Mombasa, Ouagadougou, Douala, and Alexandria are also showing signs of fast growth, he told me.

When it comes to startup funding, the report found 191 were funded by the surveyed hubs in 2018. “The fact that only 40% of the surveyed hubs offers funding to startups denotes the high diversity in the type of support that such organisations provide. Equity investment (30%) remains the most common type of funding although, as explained, hubs are often endowed with donor or sponsor money which is used for funding – often through competitions or at the end of an incubator or an accelerator programme.

“This type of cash injections are typically in the form of grants or non-equity (23% and 13%). Almost 25% of the funding is also in-kind and it is not uncommon to see mixed funding rounds including in-kind and equity investment. Finally, a small proportion includes debt financing (12%).”

Even the 25% of hubs who only offer coworking space is a huge advantage for many startups, adds Briter Bridges’s Lisa With. “Fundamental to starting a new venture is having a reasonable, safe and inspiring setting to foster ideas. For many hubs, offering a working space that is based on collaboration and flexible terms of engagement is therefore also a logical starting point of support.”

The research also identifies over 110 hubs that have shut operations in the last few years due to bankruptcy, pivoting, or the expiration of their mandate, Giuliani said.

Oral Ofori is Founder and Publisher at www.TheAfricanDream.net, a digital storyteller and producer, and also an information and research consultant.