Africa Still Prints its Money in Europe

At least 40 African countries print their money in the UK, France and Germany — decades after independence, raising questions about self-sufficiency. What prompts them to outsource their currency production?

Among the top firms that African central banks partner with are British banknote printing giant De La Rue, Sweden-based Crane, and Germany’s Giesecke+Devrient.

Only a handful of African countries, like Nigeria, Morocco, and Kenya have enough resources to print their own currencies or mint their own coins.

It is perhaps surprising that almost all African countries import their currencies. The practice could even raise questions of national pride and national security.

However, for rich countries like Angola and Ghana, there’s also the issue of real autonomy and economic sufficiency. Most countries are tight-lipped about their currency-printing processes — likely for security reasons. The printing firms are even less transparent.

Read Also: Ghana’s central bank to partner German firm to pilot digital currency

Counting the cost

Ethiopia, Libya and Angola — along with 14 other countries — place orders from De La Rue, writes Ilyes Zouari, who studies African countries.

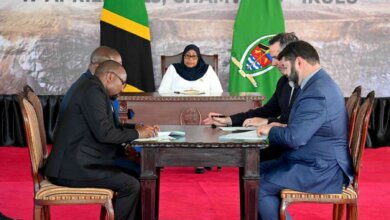

Six or seven other nations including South Sudan, Tanzania and Mauritania are said to print theirs in Germany, while most French-speaking African countries are known to print their money with France’s central bank and with the French printing company Oberthur Fiduciaire.

It’s not clear how much it costs to print African currencies like the Gambian dalasi, although the US dollar costs between 6 and 14 cents. But it is likely that the cost of printing for over 40 African currencies is significant.

In 2018, a central bank official in Ghana complained to local journalists that the country spends huge amounts for its UK orders of the Ghanaian cedi. And since countries usually order millions of notes to be carted in containers, they usually have to pay hefty shipping fees.

In The Gambia’s case, officials say shipping costs rack up a bill of £70,000 (€84,000, $92,000).

Is third-party printing secure?

Mma Amara Ekeruche from the African Center for Economics Research in an interview with DW news said some individual countries attempting to produce their own currencies could fall victim to corrupt officials or hackers who might attempt to forge or manipulate them.

Even with importing, there can be challenges. Containers of Liberian dollars shipped from Sweden disappeared in 2018, although the government later accounted for it.

Firms like De La Rue have existed for hundreds of years, mass-producing for central banks across the world.

They have the tools and experience to keep up to date with currency innovations, such as polymer which is considered cleaner, more durable and more secure than paper, with the plastic material allowing the inclusion of more sophisticated features to protect against counterfeits.

But outsourcing is not without disadvantages. Some countries could find themselves on the receiving end of economic sanctions. In 2011, for example, the UK withheld orders for Libya’s dinar from De La Rue, after the UN sanctioned the late leader, Moammar Gadhafi.

Read Also: Why Zambia’s Currency Leaped 27% Against the Dollar Last Year

Why not print the notes in Africa?

African countries have been formulating plans to boost intra-African trade. There is currently more trade with Western and Eastern countries than there is within the continent.

Printing banknotes in Africa would boost profits on the continent and, at least theoretically, African countries could choose those with printing capabilities since there’s likely some idle capacity.

But that is not happening in practice, perhaps due to trust issues since countries have been printing with overseas firms for years.

And there’s the complicated case of Francophone Africa — the countries using the Central African CFA franc and the West African CFA franc. The currencies are tightly pegged to the euro because of colonial relations and are produced in France.

Still, there’s hope that change could be on the horizon. With The Gambia’s central bank, officials proposing a possible partnership with Nigeria, countries could start to look inwards for their currency orders. If that happens at scale, it could cut shipping costs drastically.

Source: DW

Abeeb Lekan Sodiq is a Managing Editor & Writer at theafricandream.net. He’s as well a Graphics Designer and also known as Arakunrin Lekan.